United States Endoscopy Devices Market Overview

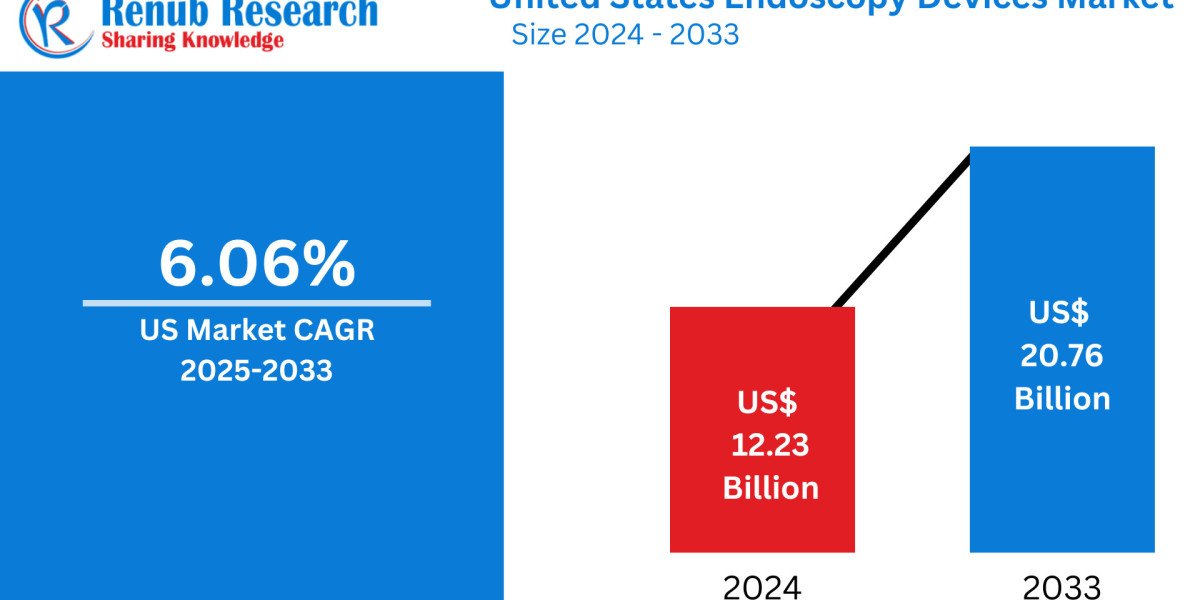

The United States Endoscopy Devices Market is projected to reach US$ 20.76 billion by 2033, up from US$ 12.23 billion in 2024, reflecting a CAGR of 6.06% from 2025 to 2033. This growth is primarily attributed to the advancements in imaging technologies, the rising prevalence of chronic diseases, the increasing adoption of minimally invasive procedures, the expansion of outpatient care settings, and the growing demand for disposable endoscopes to ensure patient safety and infection control.

Key Market Trends Driving Growth

1. Technological Advancements in Endoscopy Equipment

Continuous advancements, including 3D visualization, AI-assisted diagnostics, and high-definition imaging, have significantly improved procedural accuracy. Healthcare providers now enjoy enhanced capabilities for both diagnostics and treatment, leading to increased adoption rates. For example, UC Davis Health’s state-of-the-art endoscopy suite, launched in January 2023, aims to enhance patient care and diagnostic capacity.

2. Shift Toward Outpatient Care

There is a notable shift from inpatient treatment to Ambulatory Surgery Centers (ASCs) for endoscopic procedures. The demand for minimally invasive treatments with shorter recovery times is growing. Additionally, ASCs are becoming increasingly popular for routine diagnostic procedures, creating favorable conditions for endoscopy device market growth.

3. Aging Population and Chronic Diseases

With the aging population in the U.S., there is a rising need for endoscopic devices. Chronic diseases like gastrointestinal disorders, colorectal cancer, and neurological diseases are becoming more common, leading to a heightened demand for endoscopic solutions.

Growth Drivers for the United States Endoscopy Devices Market

1. Obesity and Bariatric Endoscopy

With the increasing rates of obesity, there is a growing demand for bariatric endoscopic procedures like endoscopic sleeve gastroplasty and intragastric balloon implantations. These minimally invasive treatments align with the need for non-surgical alternatives, leading to an uptick in the usage of endoscopic devices for weight management.

2. Growing Demand for Disposable Endoscopes

The shift towards single-use endoscopes is driven by the focus on infection control and operational efficiency. Disposable solutions, which have lower sterilization requirements and are cost-effective, are gaining popularity. Companies like NTT Corporation and Olympus Corporation are collaborating to enhance the performance of endoscopes with cloud-based systems that focus on real-time image processing.

3. AI Integration

Artificial Intelligence (AI) is revolutionizing the endoscopy landscape. AI-powered devices, like ANX Robotica's CapsuleX system, which was approved by the FDA in January 2024, are improving diagnostic accuracy and enabling early detection of gastrointestinal problems. AI helps healthcare professionals make more accurate diagnoses, boosting market growth.

Challenges in the United States Endoscopy Devices Market

1. Market Saturation and Competition

The market is highly competitive, with large players like Olympus, Medtronic, and Stryker dominating. Smaller companies face challenges in differentiating their products and gaining market share due to substantial R&D costs and regulatory hurdles.

2. Maintenance and Reprocessing of Equipment

Endoscopic devices, particularly reusable ones, require regular maintenance and sterilization to ensure optimal performance. This can be an expensive and time-consuming process, and the potential for cross-contamination poses a significant concern for patient safety. The reliance on single-use devices is a response to this challenge, though it increases operational costs.

New Publish Reports

Market Segmentation Analysis

Product Type Breakdown

- Endoscopes

- Visualization & Documentation Systems

- Mechanical Endoscopic Equipment

- Accessories

- Other Endoscopy Equipment

Application Breakdown

- Bronchoscopy

- Arthroscopy

- Laparoscopy

- Urology Endoscopy

- Neuroendoscopy

- Gastrointestinal Endoscopy

- Gynecology Endoscopy

- ENT Endoscopy

- Others

Hygiene Breakdown

- Single Use

- Reprocessing

- Sterilization

End-User Breakdown

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Others

State-Wise Market Analysis

California

California dominates the endoscopy device market, driven by its aging population, strong healthcare infrastructure, and advancements in robotics and imaging technologies. The state's focus on outpatient procedures and chronic disease management contributes significantly to its market share.

Texas

The endoscopy device market in Texas is growing rapidly due to the state's large population and expanding healthcare system. Texas is a hub for robotically assisted surgeries and high-definition imaging, driving the demand for minimally invasive endoscopic procedures.

New York

New York’s sophisticated medical infrastructure and concentration of medical research institutes make it one of the largest markets for endoscopy devices in the U.S. Technological innovations, such as 3D endoscopy and robotic-assisted systems, are improving patient outcomes and driving market expansion.

Florida

Florida’s diverse population and growing healthcare sector contribute to the rapid growth of the endoscopy device market. The state's aging demographic and increasing demand for minimally invasive procedures in fields like urology and gastroenterology are major market drivers.

Key Questions for Future Market Growth

- How will the shift towards outpatient care affect the endoscopy device market in the U.S.?

- What impact will AI integration have on the accuracy and efficiency of endoscopic procedures?

- How do advances in disposable endoscopes improve patient safety and operational efficiency in healthcare settings?

- What role does the aging population play in driving the demand for endoscopic devices?

- What are the regulatory challenges for smaller companies looking to enter the U.S. endoscopy market?

- How can endoscopy device manufacturers overcome competition from large market players like Olympus and Medtronic?

- What are the key technological innovations shaping the future of endoscopy in the U.S.?

- How do maintenance and reprocessing requirements for reusable endoscopes impact overall market costs?

- What are the prospects for endoscopic bariatric procedures as non-surgical weight loss alternatives become more prevalent?

- How will advancements in robotic-assisted surgery influence the endoscopy device market?